The Business Side of Dentistry – Theft and Embezzlement

Experts estimate that more than 40 percent of dentists are embezzled with an average loss of $50,000. But, because the embezzlers often steal small amounts of money over many years, the thief is never noticed. The US chamber of commerce estimated that 75 percent of employees steal from their workplace and that most do so repeatedly.

A majority of people, if given an opportunity, will take advantage of a situation to steal from their employer on the following frequency:

-3 percent will steal daily

-7 percent will steal weekly

-20 percent will steal 4-12 times a year

-70 percent will steal 1-2 times a year

-4 in 10 doctors experience theft in some form from the practice. 1 in 4 dental practices experience monetary theft from their practice.

The significant types of theft in dental practices are:

-Time

-Office supplies

-Dental supplies

-Goods and services in Kind

-Money

All types of theft can hurt the bottom line of the practice. The Monetary thief, in most cases, has the most negative effect on the practice bottom line. Most dentists find it hard to believe that their handpicked, trusted, longer-term staff would steal from the practice.

Here is an unfortunate, and real-life, example. A dentist had a highly successful practice with five employees. One was a long-term office manager who came to work early and left late every day. She managed all the financial transactions daily along with the insurance and statement billing. The office manager took an extended vacation. While she was gone, the office sent out statements and received numerous calls from patients that their statement was incorrect and that either their insurance had paid the bill, or they paid on the day of service by check or credit card. The doctor had the staff investigate all the disputes and found out that the office manager had embezzled more than one hundred thousand dollars over the years. He was devasted and could not believe that the long-term, most trusted employee had done this to him.

Methods that have been used by staff to steal from the practice:

- Zero Charge- Patient comes in for services, and the office staff member posts a zero-balance charge and pockets the money. At the end of the day, the computer collections balance to the deposit slip. No one notices.

- Falsify Deposit Slip– Employee brings the doctor a deposit slip to sign for the day matching all the collections taken in for the day but then takes out all the cash from the deposit bag or envelope and changes the deposit slip when depositing the money.

- Multiple Adjustments to Accounts- Courtesy discounts like cash discounts or senior discounts are used. Employee charges the full amount to the patients and keeps the cash discounts and pockets it.

- Fictitious Vendor- Employee sets up a fake business with an account and has doctor sign supply order checks for supplies. The employee deposits these checks into an account and keeps the money.

Internal Controls

Make sure that even your closest friend in the dental practice is being watched. Here are some suggested internal controls to help prevent thief and embezzlement:

- Segregation of Duties– Make sure one person does not control all cash flow processes.

- Daily Audit Trail– Review daily transactions to catch zero balance postings.

- Rotate Duties– This will help to reduce the chance for embezzlement.

- Verify the End-day Report to Deposit Slip– Ensure that you see the end-of-day report and it balances with cash deposits. The doctor should be responsible for depositing funds in the bank.

- Review Bank Statement– Take time to review the statements monthly.

- Require Vacations– All employees must take vacation days that they have earned.

- Performance Plans– If the practice meets specific goals and the practice is increasing its revenue, give incentives to employees in monetary form.

- Background Checks- Make sure you follow through on background checks before hiring new employees.

- Verify References- Check all references.

Having internal controls will help protect the practice and staff that are honest and want to do a good job. It will also help everyone stay focused on their tasks and goals at hand and take away the opportunity for someone to embezzle. You don’t want to have good employees turn into liabilities.

Omni Practice Group has been helping dentists for over 15 years developing plans for dentists to transition their practice. Our goal is to help you find the right buyer and make a smooth transition of your practice when the time is right. Contact us today for a free no-obligation consultation with one of our Practice Transition Advisors.

Read MoreWhat You Need to Know Before Signing a Covenant Not to Compete

You’ve graduated from dental school so naturally, you’re ready to get your feet wet and start seeing patients. Nearly every dentist will be an associate at the beginning of their career and with that comes the dreaded associate contract. You found a great associate opportunity and you’re eager to start collecting paychecks. But before signing that contract, particularly the non-compete clause, be aware of the details that could prevent your opportunity to start your own practice in the areas/neighborhoods you desire.

A covenant not to compete, otherwise known as a non-compete agreement, or restrictive covenant, is a clause in the contract that prohibits the restricted party from engaging in services similar to those of a non-restricted party. Non-compete agreements may restrict a dentist’s actions by time, location, and clients.

Here are some valuable tips before signing a non-compete agreement for dentists who plan on owning their own practice in the near future.

Be sure you understand every detail: Associate contracts are designed to protect the owner more so than the associate. OMNI Practice Group highly recommends you have an attorney who specializes in dental Associates contracts review all legal documents before signing. If you don’t already have an attorney, we will be more than happy to recommend one.

Advocate for the minimal non-compete radius: A standard non-compete radius should be between 3 to 5 miles. Keep in mind the radius is “as the crow flies.” In more rural areas, we have seen up to 15 to 20 miles, but of course try to negotiate for less, especially if you plan to stay in the area.

The shorter the better: We’ve seen unfavorable terms of up to five years. Typically, your non-compete clause should only be enforceable for 1 to 2 years. Try to negotiate to a shorter period, that will work in your favor when you’re ready to own your own practice.

Be sure your non-compete only covers the location in which you are employed: If your employer owns multiple locations, but you’re only seeing patients at one specific office, make sure your non-compete only applies to that location.

Notice of resignation: Keep in mind that when you’ve found the ideal practice to purchase or if you decide to do a start-up, the process can move rather quickly. We’ve seen contracts that require the associate to give up to 6 months’ notice before leaving their position – a fair amount of notice is typically 30 days. Be sure to negotiate the least amount.

My rule of thumb when it comes to associate contracts is “Less is Best” …well, with the exception of wages!

When you’re ready to purchase a practice or just want to discuss the process in preparation please feel free to reach out to me for a free no-obligation consultation. I’m here to help you.

Read MoreChoosing between Buying an Existing Practice Or Doing a New Build

Choosing between buying an existing practice and doing a start-up practice can be one of the biggest decisions of your life. Here are four considerations and two suggestions for when you are contemplating.

The four considerations:

Market Saturation – How many dentists are practicing in the area you are considering? Hardly any? One on every corner? Somewhere in between? Establishing traction in a high competition area will require a much higher marketing budget. Do you know your marketing budget? Do you have a marketing plan?

Available Practices for Sale – How many practices are for sale in the area you are considering? Do those practices have a broker representing them? Broker representation usually equates to well-substantiated pricing and a defined plan for acquisition. For-sale-by-owner practices can be more of a wild card.

Population Demographics – If you are considering an area for a new build, will the demographics of the area you are considering support your business plan?

Personal Financial Situation – Do you have the financial reserves to weather a start-up? While there are pros and cons to both routes, buying an established practice certainly generates more initial cash flow.

The two suggestions:

Get Help – This will be one of the biggest decisions of your life, whichever route you take. There are some truly skilled and experienced professionals out there that will help guide you through this process in an efficient manner and allow you to minimize risk while seizing the opportunity.

If You Can Produce, Get Moving – Are you a high producer? Can you manage and lead? Can you do great dentistry without someone looking over your shoulder? If you answered yes to these questions, what are you waiting for?

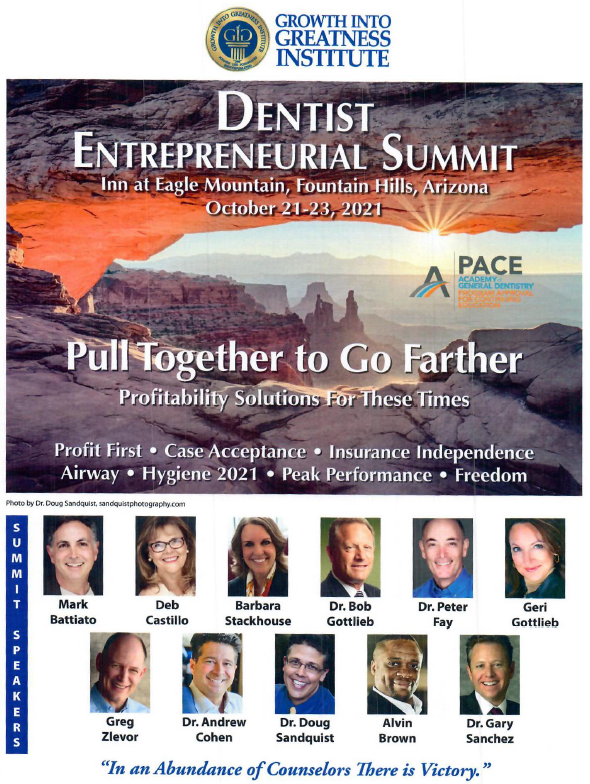

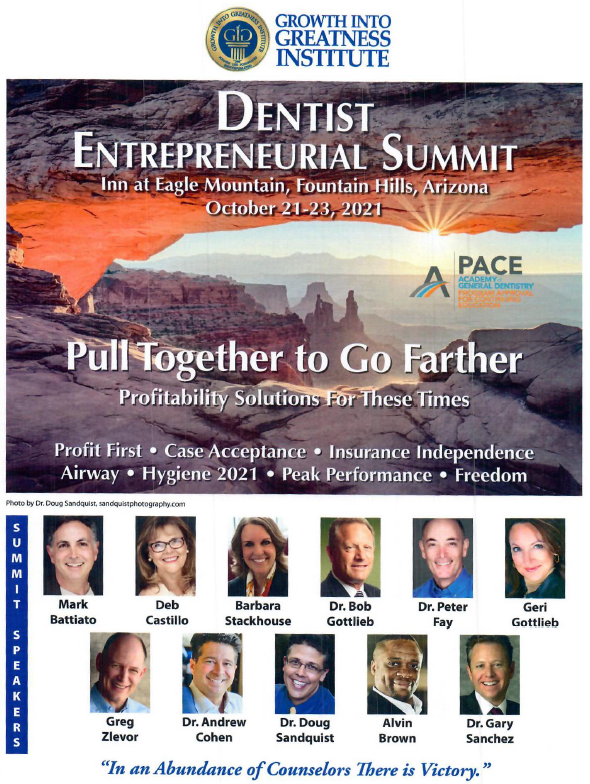

Read MoreDentist Entrepreneurial Summit 2021

What you receive when you come to the GIG M.BF. Entrepreneurial Mastermind Summit:

The GIG M.B.F. Entrepreneurial Summit is designed as a total support system for Dentists/entrepreneurs with their sights set on “sky’s-the-limit” growth and the freedom to create the kind of richly satisfying life they dreamed of when they made the decision to become a dentist.

With all the changes in dentistry and transitions with our world and life, this summit will be a way to re-energize, renew and rediscover new ways to keep our practices growing and thriving.

The GIG M.B.F. Entrepreneurial Summit is about you and your growth. You decide on your most important goals and on your game plan. We provide the structure, tools, and support that give you a new perspective on your business and a fresh way of thinking – and keep you on track to turn your new goals into reality, and to keep us moving forward.

Here’s how that happens:

1. GIG team founders, speakers, and Mastery Leadership Directors will facilitate and provide the structure for each Entrepreneurial Mastermind Summit. Much of the learning and success will come from being and interacting with like-minded dentists who encourage, challenge, and support each other.

2. At the GIG Summit, you’ll have plenty of time to focus on and strategize what’s most pressing in your business right now – and get objective feedback from the GIG team and the other successful dentists in the room. Fresh perspectives and breakthrough insights are inevitable, making it a mind-stretching, life-changing two-and-a-half-days.

3. At the end of the two-and-a-half-day Mastermind Summit, you’ll leave armed with new thinking and tools PLUS a plan with prioritized, concrete action steps for the next 6 to 12 months to share with your team. New ideas are energizing, but it’s the clarity about the action steps needed that get things done.

4. GIG Summit will provide entrepreneurial tools, support material, etc. which will accelerate learning of the different “modules.” Each dentist will end up individualizing their learning.

Why GIG Summit Now?

Growth Into Greatness Institute over the last two decades has supported Dentists through all types of practice transitions. This community of dentists will be actively engaged in new growth, tools, and support to keep reaching higher goals and personal, professional aspirations.

We have intentionally rescheduled this meeting for October 21-23, 2021, because we expect the Coronavirus to have been defeated by then and dentists will want to return to C.E. and professional growth, profitability, and success. A like-minded community of dentists sharing their experiences in this “rebirth” will surely be beneficial to everyone. Enrollment applications and RSVPs are now being accepted. The time is now We all need each other to be strong. Let’s press on together!

CLICK HERE TO DOWNLOAD FLYER & REGISTRATION FORM

Read MoreWant to Purchase a Practice?

By Megan Urban, Practice Transition Advisor

Want to purchase a dental practice? Here is a basic starting To-Do List to get you going!

– Where do you want to practice and where will you and your family be happy?

– Get your last 3 years of personal tax returns together.

– Gather your debt details: student loan, credit card, mortgage, etc.

– Start to look at your current production, or if you are in public health, monitor your procedure frequency report.

Talk with a transition specialist that can guide you through the process. They will look at some or all the following items in detail with you:

– Select a dental-specific attorney, bank, and CPA.

– Assist you to understand details of the practice, such as active patient count, expenses, insurance participation, recare, procedures completed and those referred out, potential marketing, cash flow, and due diligence in general.

Read More