Effectively Managing and Maximizing the Value of your Practice

By Kevin Brady, OMNI Practice Group

Dental Practice owners know, there’s a lot more to running the business than treating patients.

Owners are responsible for hiring and managing staff, billing patients and insurance companies, handling accounts payable and receivable, and becoming proficient on dental software to operate the practice.

All these duties have a negative impact on both the time dentists are available to their patients and the profitability of the practice.

Practice Demands

It’s no secret that dentists face increasing constraints on their time. This means providing high-quality care for their patients, which entails creating treatment plans and participating in continuing education to keep abreast of the latest innovations in dentistry.

At the same time, the dentist needs to be CEOs of their practice. In this capacity, they are tasked with:

-Hiring, training, firing, and managing staff

-Marketing the practice

-Understanding insurance changes and HIPAA regulations

-Managing the billing, collections, and account payables/receivable processes

-Ensuring the office is running smoothly

-Maintaining and enhancing office technology

-Dealing with economic conditions affecting the bottom line of the practice

A lot of dentists come out of school dreaming about doing dentistry and they become disillusioned after a short time learning that not only do they perform dentistry, they have to run a business. When a dentist is overwhelmed with the business aspects of their practice, it is time to seek help.

Outsourcing

Employing third parties to help with the daily business aspects can allow dentists to focus more on their core competencies to enrich patient care. Dentists have many choices when seeking advice and outsourcing partners. Most major software companies have additional services to help with outsourcing patient billing and insurance billing, which allows the office to go paperless. Enhancing the Billing/Collections and freeing up doctor and staff time allows the practice to be more productive and profitable.

Marketing

Developing a Marketing plan is important in building a sustainable practice over time. The ADA says a good rule of thumb when budgeting for marketing expenses is to allow 3-6% of a new practice’s expenses; 2-3% for mature practices; and about 4% for practices that are in the middle. A start-up practice should plan to spend about $40,000 on marketing during the first year, with those costs incorporated into the overall practice financing.

Internal marketing is the least expensive way to build and maintain existing patients and generate new patients. Practices that successfully connect with patients have the best marketing vehicle available – positive word of mouth that current patients share with families, friends, and coworkers that generate new patients for little or no cost.

Having a website that connects the practice with your ideal patient is critical to keeping existing patients and generating new patients. Once you have a branded site, make sure you continue to enhance it with Search Engine Optimization – (SEO). Keeping up with SEO will increase the quality and increase the visibility of the website to internet search engines.

Making sure you have the right branding and marketing strategies designed to endure the current market conditions and changes are critical for the practice to compete with larger corporate dentistry groups.

Practice Transitions – Buying or Selling a Practice

Just as dentistry is a profession that is highly trained and practiced, so are the professional services recommended for selling and buying a practice. A dentist that is looking to sell or buy a practice should seek professional help. Selling or buying a practice can have very complex processes and numerous legal, financial, and tax implications.

OMNI Practice Group is one of the experts in the industry helping dentists with developing plans for adding associates, developing transitions plans, and selling or buying a dental practice and real estate.

Omni provides:

-Practice Appraisals

-Web Practice Listing Services

-Marketing and Listing services

-Practice Real Estate and Lease services

-Banking Referral Options

Being a Dentist/CEO can present a lot of challenges with operating a dental practice in today’s market. Using the right partners can help improve efficiencies, generate new patients, and increase the value of the practice.

Contact us today for a no-obligation consultation with one of our expert Practice Transition Advisors.

Click here to connect with Kevin on LinkedIn!

Read MoreMedical Professionals: COVID-19 and your Commercial Lease

In Washington State, Governor Jay Inslee has halted all non-emergency services and elective procedures for the next 8 weeks forcing most medical offices to close during this time (hospitals, surgery centers, dental offices, etc.)

Rent is still due!

The obligation to make a rent payment is not automatically stopped because your business has been forced to close! Here are some ideas of what you can try:

Talk to your Landlord.

Engage with your landlord right away. It may be news to them that your office has been forced to close, leaving you with little to no ability to produce revenue. They might in a situation to help, though this is a negotiation not a guarantee. Ask your landlord if they would be willing to waive or reduce your rent, a 90-day deferral of rent could be option, or just pay the CAM/NNN – anything can help. Offer to make it up over time once the doors are back open and you’re treating patients. Remember the landlord may be having their own financial hardships, but they do have an interest in you being able to pay the rent for years to come.

Check-in with your Insurance Agent.

Some insurance policies have coverage for unique circumstances in the case that you are not able to run your business. This may help with covering rents and loss of wages.

Legally…

I am not an attorney, nor is this an attempt to provide legal advice. So, check-in and consult your attorney, make sure they specialize in Commercial Real Estate Law with a focus on Medical leases and contracts. On rare occasions, your lease may include Force Majeure, which could offer relief in unforeseeable circumstances that prevent someone from fulfilling a contract, but this is unlikely. After a quick review of a traditional WA State Commercial Brokers Association Lease, there was no Force Majeure clause within the document.

Ask your attorney about Common Law which is prevalent in many states. This may address the impossibility to perform and make an income, it doesn’t automatically relieve you from your rent obligation, but the fact that you are forced to perform only emergency procedures in WA State may allow for an avenue for relief.

Loan…

Banks across the nation are offering short term Small Business Loans at low rates as a method for giving small businesses financial aid. First, check-in with specific banks that focus on loans for Medical providers. Small Business Loans are available now. Some larger national banks may offer other loan programs or allow for deferred payments for the time being. Now may also be a good time to refinance your practice loan into a lower rate loan and saving you money.

If you need help getting in touch with a qualified attorney, banker, want to talk about your specific circumstances and ideas, or just want to tell me I am wrong, please contact me at Steve@omni-pg.com.

Connect with Steve on LinkedIn: https://www.linkedin.com/in/steve-kikikis-378b8697/

Read More

Washington State Medical Professionals: COVID-19 and Your Commercial Lease

by Steve Kikikis, OMNI Practice Group

by Steve Kikikis, OMNI Practice Group

In Washington State, Governor Jay Inslee has halted all non-emergency services and elective procedures for the next 8 weeks. This applies to all hospitals, surgery centers, and dental offices… forcing most medical offices to close during this time.

Rent is still due!

The obligation to make a rent payment is not automatically stopped because your business has been forced to close! Here are some ideas of what you can try:

Talk to your Landlord.

Engage with your landlord right away. It may be news to them that your office has been forced to close, leaving you with little to no ability to produce revenue. They might in a situation to help, though this is a negotiation not a guarantee. Ask your landlord if they would be willing to waive or reduce your rent, a 90 day deferral of rent could be an option, or just pay the CAM/NNN – anything can help. Offer to make it up over time once the doors are back open and you’re treating patients. Remember the landlord may be having their own financial hardships, but they do have an interest in you being able to pay the rent for years to come.

Check-in with your insurance agent.

Some insurance policies have coverage for unique circumstances in the case that you are not able to run your business. This may help with covering rents and loss of wages.

Legally…

I am not an attorney, nor is this an attempt to provide legal advice. So, check-in and consult with your attorney, and make sure they specialize in Commercial Real Estate Law with a focus on Medical leases and contracts. On rare occasions, your lease may include Force Majeure, which could offer relief in unforeseeable circumstances that prevent someone from fulfilling a contract, but this is unlikely. After a quick review of a traditional WA State Commercial Brokers Association Lease, there was no Force Majeure clause within the document.

Ask your attorney about Common Law which is prevalent in many states. This may address the impossibility to perform and make an income. It doesn’t automatically relieve you from your rent obligation, but the fact that you are forced to perform only emergency procedures in WA State may allow for an avenue for relief.

Loan…

Banks across the nation are offering short term Small Business Loans at low rates as a method for giving small businesses financial aid. First, check-in with specific banks that focus on loans for Medical providers. Small Business Loans are available now. Some larger national banks may offer other loan programs or allow for deferred payments for the time being. Now may also be a good time to refinance your practice loan into a lower rate loan and saving you money.

Contact me!

If you need help getting in touch with a qualified attorney, banker, want to talk about your specific circumstances and ideas, or just want to tell me I am wrong, please contact me at Steve@omni-pg.com.

Find me on LinkedIn: https://www.linkedin.com/in/steve-kikikis-378b8697

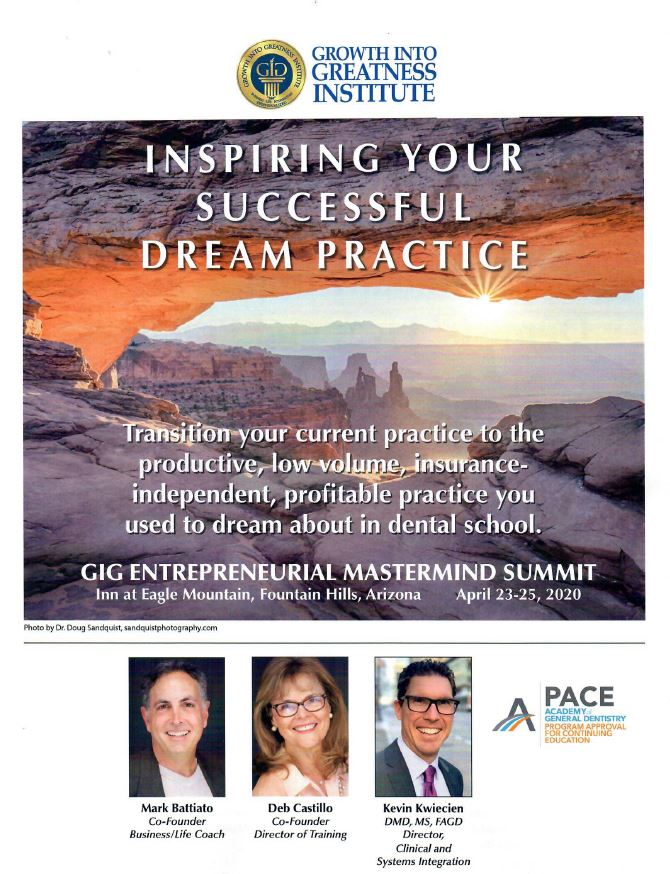

Read MoreInspiring Your Successful Dream Practice

Transition your current practice to the productive, low volume, insurance-independent, profitable practice you used to dream about in dental school.

GIG ENTREPRENEURIAL MASTERMIND SUMMIT

Inn at Eagle Mountain, Fountain Hills, Arizona

April 23-25- 2020

Please download the flyer for more information:

gig_-_mbf_flyer-brochure.pdf (2980 downloads )

Maximize Your Practice Value

Freshen up your practice – Buyers like to see a fresh, clean and somewhat updated practice. That does not mean you need to do a complete remodel and spend a $100,000. It does mean you need to take a look at your flooring and your walls. If you have large holes in your wall or your flooring was leftover linoleum from World War II, you should fix the holes and put in new flooring. Talk to your landlord, sometimes they will help with the cost. If you have equipment that is held together by the “fix everything” duct tape, contact your local equipment rep and have it fixed.

Update your technology – We run into an occasional practice owner that considers indoor plumbing as new technology. If you are in that category, or if you have not done any technology updates since Richard Nixon was president, you should look into digital x-rays and other technology that will not only appeal to buyers but will help you increase your production in the practice. Contact your equipment rep for the latest and great technology.

Financial Review – Have a meeting with your financial planner or advisor to see where you currently stand with your retirement portfolio. This will help determine how soon you can possibly retire, how much more you may need to put away to retire and/or how much you need to get out of your practice sale in order to retire.

Practice Valuation – You should get a valuation done on your practice. This will help your financial planner and you see where you stand with your entire portfolio. Some doctors rely heavily on their practice sale to be a piece of their retirement nest-egg, so if you don’t know what your practice may be worth, you don’t know what size of nest-egg you have. Call Omni for a free snapshot valuation.

Clean up your books – If you have been aggressive in running expenses and other items through payroll, you should work on making sure the books are clean. If you have multiple practices, but run all of your income and expenses through one tax id number, you should ensure you can separate the income and expenses of both practices. Meet with your CPA to analyze your numbers and see if you are in line with industry averages.

Grow your practice – One of the worst things you can do is take your foot off of the gas pedal. If you want to maximize the value of your practice, keep production at least level with prior years. A growing practice sells quicker and easier than a dying practice. If you don’t know how to grow your practice and make it more sellable, contact a consultant, or have a practice assessment done.

These are just a few items that you can do to help prepare your practice for a sale. If you work on these items now and over the next 3 years, you will maximize your practice value, enlarge your pool of potential buyers and be able to sell your practice quicker.