The Business Side of Veterinary Medicine – Theft & Embezzlement

Experts estimate that more than 70 percent of veterinarians are embezzled with an average loss of $200,000. But, because the embezzlers often steal small amounts of money over many years, the thief is never noticed. The US chamber of commerce estimated that 75 percent of employees steal from their workplace and that most do so repeatedly.

A majority of people, if given an opportunity, will take advantage of a situation to steal from their employer on the following frequency:

-3 percent will steal daily

-7 percent will steal weekly

-20 percent will steal 4-12 times a year

-70 percent will steal 1-2 times a year

-4 in 10 doctors experience theft in some form from the practice. 1 in 3 veterinary practices experiences monetary theft from their practice.

The significant types of theft in veterinary practices are:

-Time

-Office supplies

-Veterinary supplies

-Goods and services in Kind

-Money

All types of theft can hurt the bottom line of the practice. The Monetary thief, in most cases, has the most negative effect on the practice bottom line. Most veterinarians find it hard to believe that their handpicked, trusted, longer-term staff would steal from the practice.

Here is an unfortunate, and real-life, example. A veterinarian had a highly successful practice with five employees. One was a long-term office manager who came to work early and left late every day. She managed all the financial transactions daily along with the insurance and statement billing. The office manager took an extended vacation. While she was gone, the office sent out statements and received numerous calls from patients that their statement was incorrect and that either their insurance had paid the bill, or they paid on the day of service by check or credit card. The doctor had the staff investigate all the disputes and found out that the office manager had embezzled more than one hundred thousand dollars over the years. He was devasted and could not believe that the long-term, most trusted employee had done this to him.

Methods that have been used by staff to steal from the practice:

Zero Charge- Patient comes in for services, and the office staff member posts a zero-balance charge and pockets the money. At the end of the day, the computer collections balance to the deposit slip. No one notices.

Falsify Deposit Slip– Employee brings the doctor a deposit slip to sign for the day matching all the collections taken in for the day but then takes out all the cash from the deposit bag or envelope and changes the deposit slip when depositing the money.

Multiple Adjustments to Accounts- Courtesy discounts like cash discounts or senior discounts are used. Employee charges the full amount to the patients and keeps the cash discounts and pockets it.

Fictitious Vendor- Employee sets up a fake business with an account and has doctor sign supply order checks for supplies. The employee deposits these checks into an account and keeps the money.

Internal Controls

Make sure that even your closest friend in the veterinary practice is being watched. Here are some suggested internal controls to help prevent thief and embezzlement:

Segregation of Duties– Make sure one person does not control all cash flow processes.

Daily Audit Trail– Review daily transactions to catch zero balance postings.

Rotate Duties– This will help to reduce the chance for embezzlement.

Verify the End-day Report to Deposit Slip– Ensure that you see the end-of-day report and it balances with cash deposits. The doctor should be responsible for depositing funds in the bank.

Review Bank Statement– Take time to review the statements monthly.

Require Vacations– All employees must take vacation days that they have earned.

Performance Plans– If the practice meets specific goals and the practice is increasing its revenue, give incentives to employees in monetary form.

Background Checks- Make sure you follow through on background checks before hiring new employees.

Verify References- Check all references.

Having internal controls will help protect the practice and staff that are honest and want to do a good job. It will also help everyone stay focused on their tasks and goals at hand and take away the opportunity for someone to embezzle. You don’t want to have good employees turn into liabilities.

Omni Practice Group has been helping veterinarians for over 15 years developing plans to transition their practice. Our goal is to help you find the right buyer and make a smooth transition of your practice when the time is right. Contact us today for a free no-obligation consultation with one of our Practice Transition Advisors.

Read MoreThe Business Side of Dentistry – Theft and Embezzlement

By Kevin Brady, Practice Transition Advisor

By Kevin Brady, Practice Transition Advisor

Experts estimate that more than 40 percent of dentists are embezzled with an average loss of $50,000. But, because the embezzlers often steal small amounts of money over many years, the thief is never noticed. The US chamber of commerce estimated that 75 percent of employees steal from their workplace and that most do so repeatedly.

A majority of people, if given an opportunity, will take advantage of a situation to steal from their employer on the following frequency:

-3 percent will steal daily

-7 percent will steal weekly

-20 percent will steal 4-12 times a year

-70 percent will steal 1-2 times a year

-4 in 10 doctors experience theft in some form from the practice. 1 in 4 dental practices experience monetary theft from their practice.

The significant types of theft in dental practices are:

-Time

-Office supplies

-Dental supplies

-Goods and services in Kind

-Money

All types of theft can hurt the bottom line of the practice. The Monetary thief, in most cases, has the most negative effect on the practice bottom line. Most dentists find it hard to believe that their handpicked, trusted, longer-term staff would steal from the practice.

Here is an unfortunate, and real-life, example. A dentist had a highly successful practice with five employees. One was a long-term office manager who came to work early and left late every day. She managed all the financial transactions daily along with the insurance and statement billing. The office manager took an extended vacation. While she was gone, the office sent out statements and received numerous calls from patients that their statement was incorrect and that either their insurance had paid the bill, or they paid on the day of service by check or credit card. The doctor had the staff investigate all the disputes and found out that the office manager had embezzled more than one hundred thousand dollars over the years. He was devasted and could not believe that the long-term, most trusted employee had done this to him.

Methods that have been used by staff to steal from the practice:

- Zero Charge- Patient comes in for services, and the office staff member posts a zero-balance charge and pockets the money. At the end of the day, the computer collections balance to the deposit slip. No one notices.

- Falsify Deposit Slip– Employee brings the doctor a deposit slip to sign for the day matching all the collections taken in for the day but then takes out all the cash from the deposit bag or envelope and changes the deposit slip when depositing the money.

- Multiple Adjustments to Accounts- Courtesy discounts like cash discounts or senior discounts are used. Employee charges the full amount to the patients and keeps the cash discounts and pockets it.

- Fictitious Vendor- Employee sets up a fake business with an account and has doctor sign supply order checks for supplies. The employee deposits these checks into an account and keeps the money.

Internal Controls

Make sure that even your closest friend in the dental practice is being watched. Here are some suggested internal controls to help prevent thief and embezzlement:

- Segregation of Duties– Make sure one person does not control all cash flow processes.

- Daily Audit Trail– Review daily transactions to catch zero balance postings.

- Rotate Duties– This will help to reduce the chance for embezzlement.

- Verify the End-day Report to Deposit Slip– Ensure that you see the end-of-day report and it balances with cash deposits. The doctor should be responsible for depositing funds in the bank.

- Review Bank Statement– Take time to review the statements monthly.

- Require Vacations– All employees must take vacation days that they have earned.

- Performance Plans– If the practice meets specific goals and the practice is increasing its revenue, give incentives to employees in monetary form.

- Background Checks- Make sure you follow through on background checks before hiring new employees.

- Verify References- Check all references.

Having internal controls will help protect the practice and staff that are honest and want to do a good job. It will also help everyone stay focused on their tasks and goals at hand and take away the opportunity for someone to embezzle. You don’t want to have good employees turn into liabilities.

Omni Practice Group has been helping dentists for over 15 years developing plans for dentists to transition their practice. Our goal is to help you find the right buyer and make a smooth transition of your practice when the time is right. Contact us today for a free no-obligation consultation with one of our Practice Transition Advisors.

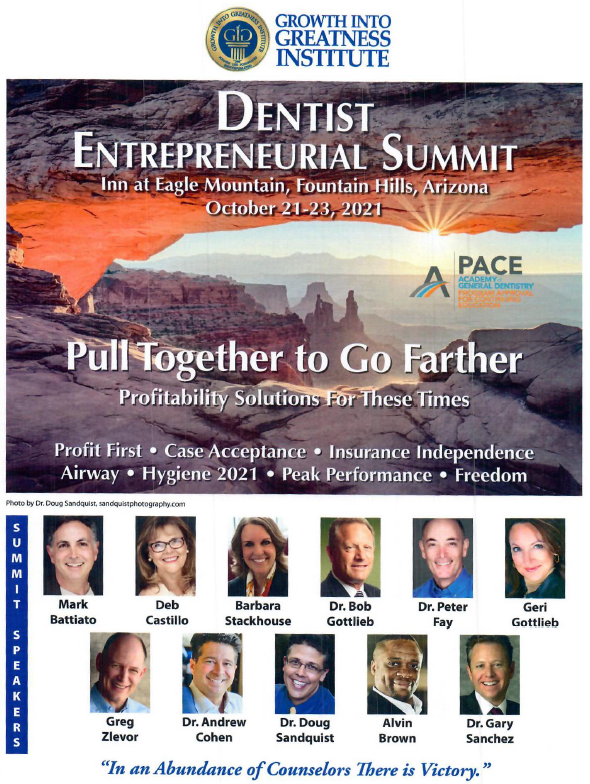

Read MoreDentist Entrepreneurial Summit 2021

What you receive when you come to the GIG M.BF. Entrepreneurial Mastermind Summit:

The GIG M.B.F. Entrepreneurial Summit is designed as a total support system for Dentists/entrepreneurs with their sights set on “sky’s-the-limit” growth and the freedom to create the kind of richly satisfying life they dreamed of when they made the decision to become a dentist.

With all the changes in dentistry and transitions with our world and life, this summit will be a way to re-energize, renew and rediscover new ways to keep our practices growing and thriving.

The GIG M.B.F. Entrepreneurial Summit is about you and your growth. You decide on your most important goals and on your game plan. We provide the structure, tools, and support that give you a new perspective on your business and a fresh way of thinking – and keep you on track to turn your new goals into reality, and to keep us moving forward.

Here’s how that happens:

1. GIG team founders, speakers, and Mastery Leadership Directors will facilitate and provide the structure for each Entrepreneurial Mastermind Summit. Much of the learning and success will come from being and interacting with like-minded dentists who encourage, challenge, and support each other.

2. At the GIG Summit, you’ll have plenty of time to focus on and strategize what’s most pressing in your business right now – and get objective feedback from the GIG team and the other successful dentists in the room. Fresh perspectives and breakthrough insights are inevitable, making it a mind-stretching, life-changing two-and-a-half-days.

3. At the end of the two-and-a-half-day Mastermind Summit, you’ll leave armed with new thinking and tools PLUS a plan with prioritized, concrete action steps for the next 6 to 12 months to share with your team. New ideas are energizing, but it’s the clarity about the action steps needed that get things done.

4. GIG Summit will provide entrepreneurial tools, support material, etc. which will accelerate learning of the different “modules.” Each dentist will end up individualizing their learning.

Why GIG Summit Now?

Growth Into Greatness Institute over the last two decades has supported Dentists through all types of practice transitions. This community of dentists will be actively engaged in new growth, tools, and support to keep reaching higher goals and personal, professional aspirations.

We have intentionally rescheduled this meeting for October 21-23, 2021, because we expect the Coronavirus to have been defeated by then and dentists will want to return to C.E. and professional growth, profitability, and success. A like-minded community of dentists sharing their experiences in this “rebirth” will surely be beneficial to everyone. Enrollment applications and RSVPs are now being accepted. The time is now We all need each other to be strong. Let’s press on together!

CLICK HERE TO DOWNLOAD FLYER & REGISTRATION FORM

Read More7 Questions to Ask When Forming a Partnership

By Jim Vander Mey, CPA, ABI, Practice Transition Advisor

By Jim Vander Mey, CPA, ABI, Practice Transition Advisor

You and your friend from school want to purchase a practice together. Here are just a few questions to ask.

A sole owner is often an easier path to ownership, but partnerships can certainly be successful. But like any healthy relationship, it requires work. To help prepare consider getting together with your business partner, turn off the cell phones, meet in a closed room, and ask the following questions to each other.

How much debt do you have?

Does your business partner have a bankruptcy in their past? Do they secretly owe their parents money for school? Do they drive a BMW 7 series, and you drive a Yugo? (google it!) Pre-existing debt could limit your financial flexibility for emergencies and growth. Will their spending and saving style affect how they run the practice?

How updated does the practice need to be?

We have seen state-of-the-art practices that have been remodeled every 5 years and converted 50-year-old homes. Both can be profitable. We have seen many practices that do not follow textbook expense percentages, but still have excellent reputations, and are extremely profitable.

Number of staff?

You want a Licensed Tech with you at all times, and your partner doesn’t. You want to hire a cleaning service, but your partner wants to come in on Sunday afternoons and clean the practice to save money.

Equipment purchases?

You want a fully digital x-ray and a new surgical laser, and your partner is fine with a CR x-ray and a used ultrasound. Now what?

Vacation? Sick?

You want to take 6 weeks off every year to coincide with your spouse’s vacation and your partner only wants a couple of weeks off. Does your compensation arrangement cover this? Even if you compensate for the difference, will you feel comfortable with this?

Skeletons in the closet?

Yes, you got along famously in school… Studied together, got along socially, have a similar philosophy regarding practicing, etc. Do you both need to agree to a full background check, as in searching for bankruptcy and criminal activity?

How will you solve disagreements?

You probably won’t see eye to eye on everything. Assume you will be diametrically opposed to your partner on an issue – how will this be resolved? What if disaster strikes? Or what if you need to move out of state to take care of a family member? Or what if your spouse has an out-of-state opportunity, or a permanent debilitating health issue arises. What if it ultimately leads to the point that you no longer want to be co-owners and you get to the point where you have the ultimate disagreement and just cannot get along? What is the break-up formula?

Answer Key to above questions

The answer to the above of course is – there are no set answers. It will vary from partnership to partnership, person to person what will work. Long before you make an offer on a practice, set some time aside to discuss the above questions – at the very least discuss the last paragraph. And of course, we recommend meeting with a veterinary attorney to form your partnership agreement.

Read MoreWhen is it Time to Value Your Practice?

By Kevin Brady, Practice Transition Advisor

By Kevin Brady, Practice Transition Advisor

Transitioning the practice is probably one of the biggest decisions a dentist will make in their career. Deciding whether to transition the practice to a partner, associate, a new dentist, or corporate dentistry, you will need a plan and experts to help you make the right decision.

3 to 5 Years Before Retirement

Having a financial plan when you are 3-5 years out from selling your practice will allow you to know what the total value of your assets are and what value is needed from your practice to afford to retire. Knowing the value of the practice 3-5 years out will also allow you to focus on reducing debt, increasing production, and collections, which are critical factors in determining the practice valuation.

When developing your financial plan, you will need to have your CPA do a thorough review and analysis of your financials and advise of any necessary adjustments. This would include family members on the payroll who don’t work in the office, expenses that are above industry averages, and other expense benefits being run through the practice. Review your internal and external marketing programs with your marketing professional to focus on increasing new patients and adding additional revenue to the practice.

1 to 2 Years Before Retirement

Once you have an established financial plan and are 1-2 years from retirement, you need to find a dental broker to help with a practice valuation and options for selling your practice.

The benefits of enlisting a professional dental broker are:

- Independent and accredited appraisal of your practice’s worth, the patient population, equipment, and, if applicable, the real estate.

- Knowing what your minimum sales price will need to be to meet your financial goals to retire.

- Exploring the different buyer options for the sale and which one is right for you.

- Developing a marketing plan for your practice that will keep it confidential until a buyer is found.

- Determining the average length of time it will take to market and sell your practice.

- Identifying what improvements or changes could make the practice more attractive to potential buyers.

1 Year or Less Before Retirement

It is time to implement your plan to sell the practice. The average practice takes 6-8 months to sell Pre COVID-19. Some rural practices might average 18 -24 months to sell. Enlisting a professional broker will save you time putting together a marketing prospectus and then marketing the practice locally and nationally. A broker can also assist you with updating your valuation to determine the asking price for the practice. Keys areas to focus on with less than a year are reducing as much debt as possible and keeping the hygiene and doctor production as high as possible.

There is no doubt that the COVID-19 pandemic has created new considerations for anyone who is considering selling their dental practice. Selling a dental practice doesn’t happen overnight. Developing a plan with experts can ensure you get what you want out of a sale while maximizing your dental practice’s value and allowing for a smooth transition to the purchaser.

Omni Practice Group has been helping dentists for over 15 years develop plans for dentists to transition their practice. Our goal is to help you find the right buyer and make a smooth transition of your practice when the time is right.

Contact us today for a free no-obligation consultation with one of our Practice Transition Advisors. We are here to help – Kevin@omni-pg.com.

Read More